The new bad cons are the ones in which men and women are paying good large upfront fee and nothing happens to the figuratively speaking, told you education loan pro Robert Farrington, just who works web site known as College Trader. Inside the pretty much every scenario … the fresh new education loan debtor is beyond currency. The newest worst I’ve seen was upward regarding $2,five hundred to help you $step three,100000. Other programs grab the money and you may drop-off. These firms operate illegally in many ways, also recharging unlawful improve fees just before getting one services, misleading users concerning the costs of its qualities, incorrectly guaranteeing all the way down monthly payments, falsely stating brief relief from default otherwise garnishment, and you will wrongly symbolizing an affiliation towards You.S. Agencies from Degree, a customer Economic Security Bureau representative advised The latest Ringer.

In most circumstances, the businesses unknown that they are present simply to earnings. Because a loan servicer towards government, Navient needed to assist anybody learn about and you may register having choice payment agreements, along with you to targeted at people who have lowest profits. Nevertheless the Consumer Monetary Defense Bureau’s criticism alleges you to Navient methodically deterred individuals regarding signing up for the proper plan, and you can steered him or her into plans that harm them economically.

The draws are so active since they are laced with just sufficient details to look possible. Brand new Obama connect appears credible as the Obama administration did establish an option regarding software designed to relieve the load off student loans, also fees preparations centered on income. (And possibly Chairman Obama’s focus on guarantee left an effective subliminal feeling regarding manner.) But Obama’s education loan forgiveness bundle was not concocted regarding White Family. It’s a good hustler’s advancement, an untrue catchphrase made to raise hopes.

Education loan forgiveness frauds took from merely lately, nevertheless they features a link with a special Great Credit crunchera swindle: the mortgage forgiveness swindle. In the event the CFPB turn off a swindle entitled Student Aid Institute Inc. within the , Movie director Richard Cordray indexed the fresh new parallels between them types of swindle. We see a lot more about people and you will websites demanding large initial charge to help student loan consumers subscribe money-motivated plans that exist free of charge, Cordray said within the a statement. These types of strategies bear a disturbing similarity on the home loan crisis in which troubled users was basically preyed on that have not true guarantees out-of save. We’re going to always turn off unlawful cons and you can target sloppy repair means you to definitely victimize people, he told you, writing about a quick out of rip-offs targeting someone affected by the loan drama on the late 2000s.

But really Education loan Care for expected customers to quit the PINs

Brand new U.S. Institution regarding Studies informed college students facing these companies just last year, in an article titled Don’t be Fooled: You don’t Need to pay for Student loan Let sufficient reason for a great YouTube films starring John King, then your acting degree assistant.

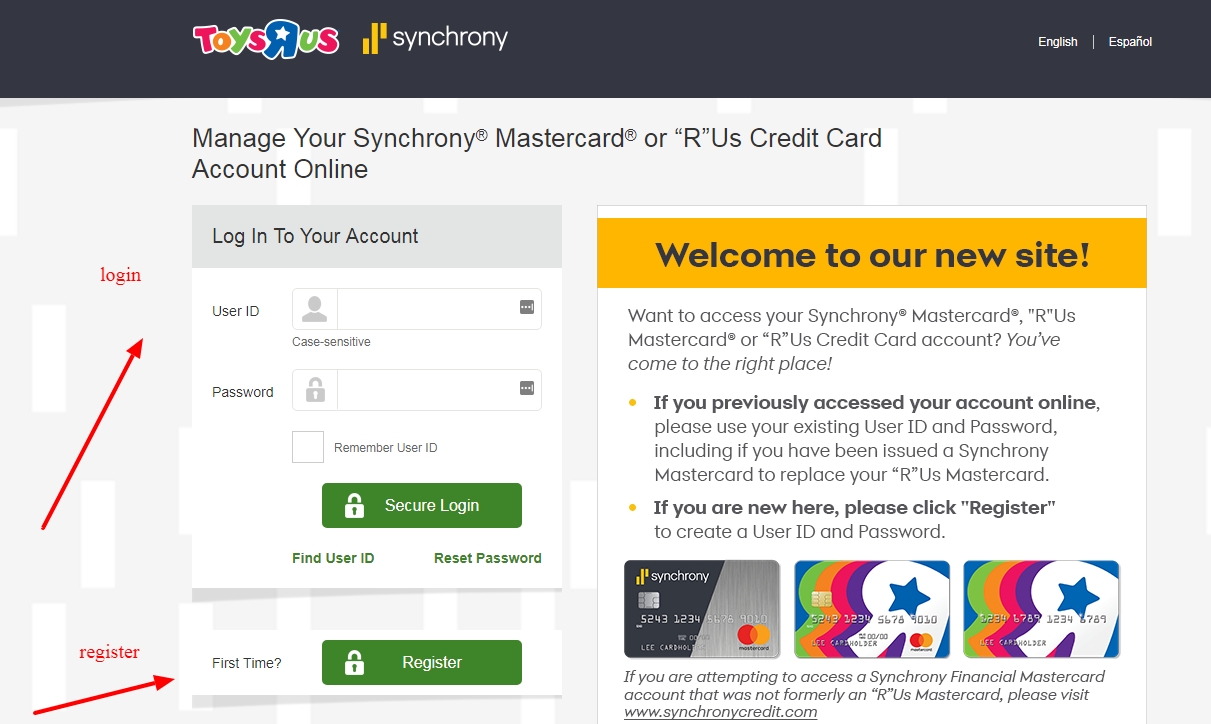

Illinois Attorney Standard Lisa Madigan has brought an intense method https://worldpaydayloans.com/payday-loans-mn/little-falls/ to penalizing these businesses, in addition to legal actions this lady workplace features filed promote a window for the so it industry. That match, up against a family doing work because the Education loan Handle, comes with pictures that AG says tell you how the company hijacked the fresh new icon out-of a legitimate team provide off the perception out of professionalism.

It make the most of complicated government mortgage cost and you may combination agreements, and exactly how nothing organizations for example Navient (whoever suit is ongoing) do in order to let members of you desire

According to the suit, Student loan Manage drops to the very first sounding education loan scams: It can techniques student loan data, that it cannot bring money and you may fall off. However, because lawsuit explains, the Agency away from Education’s advice claims one to pupil consumers are not permitted to promote anybody their personal identity count so you can log on and change fee options. They framed its provider just like the an approach to higher cost choices, which have says including, I’ve Forgiveness Applications to help individuals who are when you look at the eligible disciplines. (Stress from the Illinois AG.)